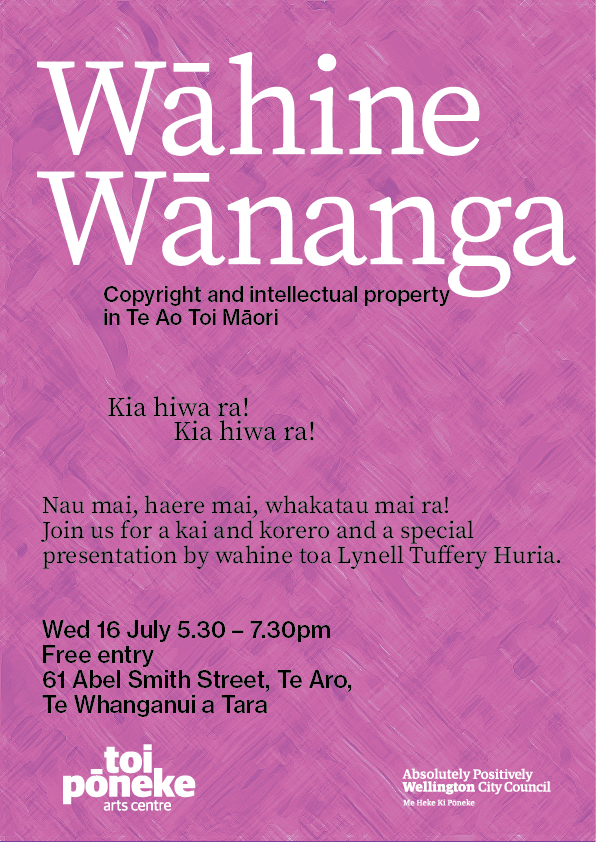

Wāhine Wānanga

- Toi Pōneke Arts Centre 61 Abel Smith Street, Te Aro, Wellington Wellington New Zealand (map)

Copyright and Intellectual Property in Te Āo Toi Māori

Kia hiwa ra! Kia hiwa ra!

Nau mai, haere mai, whakatau mai ra!

Join us at Toi Pōneke for our second Wāhine Wānanga for artists. A presentation from wāhine toa Lynell Tuffery Huria about copyright and intellectual property in Te Āo Toi Māori (The World of Māori Arts).

Lynell Tuffery Huria (Ngāti Ruanui, Ngāruahinerangi, Ngaa Rauru Kiitahi)

Lynell is recognised as the first Māori Patent Attorney and is acknowledged as a leading expert on indigenous intellectual property rights, Māori intellectual property and trade mark protection.

Over the last 30 years, Lynell has worked for a large intellectual property specialist firm, advising a wide variety of clients including whanau, hapū, and iwi, sole traders, companies, and multi-national corporations.

Lynell is keen to continue to assist Māori to navigate the intellectual property system and develop new and innovative ways to protect our cultural heritage.

Wed 16 July, 5:30pm - 7:30pm

Toi Pōneke, 61 Abel Smith Street, Te Aro

Free entry - Limited spaces so booking is essential.